How Far Does a Little Ignorance Go for Pricing Power?

A paper inspired by real-world economic phenomena.

I. Abstract

This paper is inspired by the seemingly inexplicable disparity in prices for standard unleaded gas between the Irving and Exxon gas stations in Hanover, New Hampshire. I will explain why I anticipated Bertrand price competition to produce a one-price equilibrium between the two stations. I then will explore a sample of the theoretical literature on the existence of multiple-price equilibria for homogeneous goods. I will argue that the Hotelling location model’s explanation of pricing power on the basis of search costs is not responsible for the Exxon-Irving price disparity. The last theory I will consider is Salop and Stiglitz’s model of monopolistically competitive price dispersion based on information-gathering-costs and more and less ignorant consumers. Finally, I will conclude that Salop and Stiglitz’s model best explains the price disparity between the Exxon and Irving stations.

II. Introduction

On January 13, 2023, I drove into Hanover from Lebanon. During this short drive, I passed by two gas stations approximately 1.4 miles apart: Irving Oil, located at 220 Lebanon St, Hanover, NH, and Exxon, located at 51 S Park St, Hanover, NH. In this paper, I operate under the assumption that the distance between the two stations is negligible enough such that local drivers stopping at either must know of the existence of both. I believe this assumption is reasonable given the on-board gas-station-finding tech and the smallness of the Hanover township. Given my assumption of perfect or relatively costless, both in terms of cost (zero) and time (several seconds), information about the stations and their offerings, I expected that the retail gas prices for standard gas to be nearly identical, if not exactly the same.

I had my expectation proven false; the standard-grade gas at Irving was priced at $3.09 while Exxon’s was priced at $3.39. The price difference of $0.30 can also be understood as Exxon’s gas costing nearly 10% (9.7%) more per gallon than Irving’s. Given the perfect homogeneity of the firms’ products, there is no obvious way to vertically differentiate Exxon’s gasoline from Irving’s. Given the relative proximity of the two stations, there appears, prima facie, to be little horizontal differentiation. Provided this lack of differentiation, the Bertrand model would predict price competition down to marginal cost. Simply put, why would any driver shop at Exxon when they could drive approximately 3-to-5 minutes down the road and save 10% per gallon? Perhaps the distance between the two stations constitutes a greater transportation cost than I have presumed and the Hotelling model can help us understand the pricing power exhibited by Exxon. Before delving into the Hotelling model, I will explain Bertrand’s model of price competition.

III. Bertrand-style Price Competition

Bertrand-style price competition occurs between any number of firms with identical, perfectly homogeneous goods or services. As a simple example, take two stores selling Dixon Ticonderoga #2 pencils. There is no difference between the two firms’ offerings and, importantly, neither store is capacity-constrained; the number of Dixon Ticonderoga #2 pencils demanded by the entire market, Q, is less than the inventory, I, of each store. In mathematical notation, Q < Ii, where i is a variable representing either of the two stores. Moreover, let us specify that the two stores are right next to each other such that there are neither search nor switching costs a la Hotelling model. Moreover, firm 1 and firm 2 have equal brand reputation and do not bundle their pencils with other products to differentiate their offerings.

In this stylized oligopolistic scenario, if firm i were to set price, Pi, such that Pi > Pj, the price set by the other firm, firm j would capture the entire market by the law of demand. Consequently, each firm has an incentive to price their pencils slightly lower than the other firm until Pi = MC. That is, although there are far fewer firms than in a perfectly competitive market, the price set by the oligopolistic firms in Bertrand price competition is also equal to marginal cost, thereby achieving the same allocative efficiency witnessed in perfectly competitive markets. Let’s also specify that both stores have the same cost function, C = MC, and marginal cost equals an identical wholesale price, MC = W, paid to Dixon Ticonderoga to procure their pencils for sale. Therefore, in the absence of collusion, a repeated game occurs in which the price set by both firms dynamically shifts lower and lower until Pi = MC = W, qi = Q/2, and i = (Pi - W)(Q/2) = 0, i.e., normal profits.

IV. Hotelling Location Model

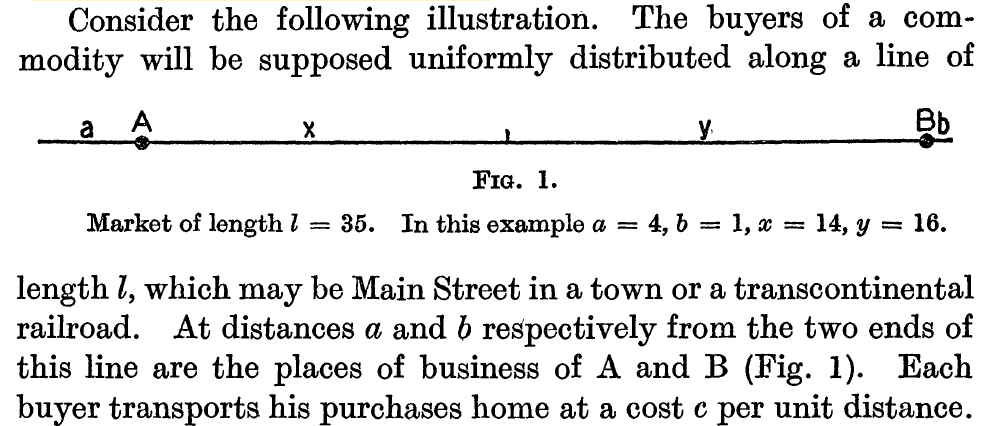

In his 1929 model, Harold Hotelling endeavors to explain the perplexing fact that “of all the purchasers of a [homogenous] commodity, some buy from one seller, some from another, in spite of moderate differences of price” (italics added). This observed reality presents a substantive challenge to the 1883 Bertrand model that predicts one firm’s “slight reduction in price take[s] away all his opponent's business and nearly double[s] his own profits,” (italics added), leading to a price war until the stable equilibrium of Pi = MC is reached. Hotelling accounts for the absence of strict Bertrand price competition by including the “stabilizing effect of masses of consumers placed [geographically or in terms of consumer tastes] to have a natural preference for one seller of the other,” as represented graphically in Figure 1:

Hotelling conceives of markets as a continuum across which consumers’ non-price demands (represented as travel costs in the above figure) account for continuous changes in quantities demanded from the two firms instead of a discontinuity in quantity demanded. Hotelling’s model predicts the multiple-price equilibria—in the case of two firms a “pair of minimum prices”—observed in the real world and explains why the single, minimum-price equilibrium resulting from the Bertrand-style price wars needn’t occur in all oligopolistic market environments in which firms are compete on price.

V. Salop and Stiglitz’s Model of Monopolistically Competitive Price Dispersion

While the Hotelling location model certainly contributes to our theoretical understanding of the multiple-gas-price equilibrium between Irving and Exxon, the relative proximity of the two suggests that this effect should be marginal. But what if drivers are unaware of the existence of the Irving station, its proximity to Hanover proper, and its significantly less expensive gas? Heterogeneity of consumer rationality is exactly what Steven Salop and Joseph Stiglitz set about investigating with a simplified market model in which perfect price-information can be gathered by consumers who “differ in their information-gathering costs due to differences in analytic ability, the cost of time and preference for reading and processing information.”

Similar to the Hotelling model, Salop and Stiglitz reject Bertrand-style single-price equilibrium as the only Nash equilibrium configuration. One of the consequences of “costly information-gathering is that the equilibrium will not occur at the perfectly competitive price” because some firms stand to strictly gain profit by charging a price higher than the perfectly competitive one by some factor < c, where c is the search cost for some portion of consumers. I find the Salop-Stiglitz model to be more descriptive than the Hotelling model because it permits that search costs, c, differ for different consumers. That is, the model acknowledges that it isn’t just the absolute difference in “location,” geographic or otherwise, between firms but the cost consumers incur in determining this difference that provides them with pricing power.

Salop and Stiglitz’s simplified market of costly information-gathering posits four possible Nash equilibrium configurations. The third is the most relevant to the Irving-Exxon example that inspired me to write this paper: “A Two-Price Equilibrium (TPE) in which the lower price, Pi, is the competitive price, and the higher price, Ph, is no greater than the monopoly price.” The TPE seems to describe what I observed between Exxon and Irving. The case for the Salop and Stiglitz TPE is bolstered by the fact that I observed a third Hanover gas station on January 13, the Irving station located at 73 S Main St, with a price virtually equal to the first Irving station: $3.06 $3.09 < $3.39. Therefore, we can see that there aren’t as many prices as there are firms (n), i.e., P=2 not because n=2, but P2 while n=3.

VI. Conclusion: A Tentative Theoretical Explanation of the Exxon-Irving Price Differential

Bertrand-style price competition fails to account for the multiple-price equilibrium between Exxon and Irving’s homogeneous gasoline products. The Hotelling location model, while accounting for such an equilibrium, I find dubious to apply to the Exxon-Irving example because of the proximity of the two firms. I find the Salop-Stiglitz model to provide the most convincing explanation of the persistent Exxon-Irving price difference in Hanover, New Hampshire. First, their theory of monopolistically competitive price dispersion accounts for the two-price equilibrium (TPE). Second, one can imagine the high- and low-information-gathering-cost consumers integral to their model in the Exxon-Irving example. For example, the wealthier, older, less-technologically-savvy Hanover drivers may be rationally ignorant of Irving’s lower prices because the cost of acquiring this information simply doesn’t outweigh the marginal benefit of tens of cents on the gallon. These drivers, given their age and wealth, would exhibit higher time preference and discount future savings on gasoline expenditures much more so than college drivers with an abundance of time, low-cost access to information via the internet, and a dearth of wealth.

VII. Limitations

I would like to acknowledge the limitations of this paper and specify areas of further study. I do not know the demographic composition of Exxon and Irving customers, so I cannot determine if or how this is related to information-gathering-costs. Doing so is crucial to evaluating whether or not the two-price equilibrium is described by the Salop-Stiglitz model or just so happens to coincide with the model’s predictions. At the beginning of the paper, I assume that the cost functions of the gas stations are equal. Specifically, I assume that C = MC = W. I did not determine whether or not Exxon and Irving’s wholesale prices are equal to each other. I believe I have good reason to believe that the wholesale prices are not the same; after some preliminary research, I discovered that Hanover’s nearest Exxon refinery is located approximately 961 miles away in Will County, Illinois while the nearest Irving refinery is less than half as remote: a mere 464 miles away in Saint John, New Brunswick, Canada. While this is far from conclusive evidence of wholesale price differences due to disparate transportation costs from refinery to station, the question clearly merits further consideration.

VIII. Bibliography

J. Bertrand, “Théorie Mathematique de la Richesse Sociale,” Journal des Savants 68 (1883):

499–508.

Hotelling, Harold. “Stability in Competition.” The Economic Journal 39, no. 153 (1929): 41–57. https://doi.org/10.2307/2224214.

Salop, Steven, and Joseph Stiglitz. “Bargains and Ripoffs: A Model of Monopolistically Competitive Price Dispersion.” The Review of economic studies 44, no. 3 (1977): 493–510.

Watson Joel. 2013. Strategy : An Introduction to Game Theory Third ed. New York: W.W. Norton & Company: 115-117.